Making the major modification in the four-month-old GST regime, the GST Council on Friday stimulated 80 percent of items in the top 28 percent tax brace to lower rates. Tax rates on over 200 things, containing beauty products, chewing gums, chocolates, coffee, and custard powder, among others, were reduced from 28% to 18%, Finance Minister Arun Jaitley said after the 23rd GST Council meeting in Guwahati.

Here Are 6 things about new rates of GST:

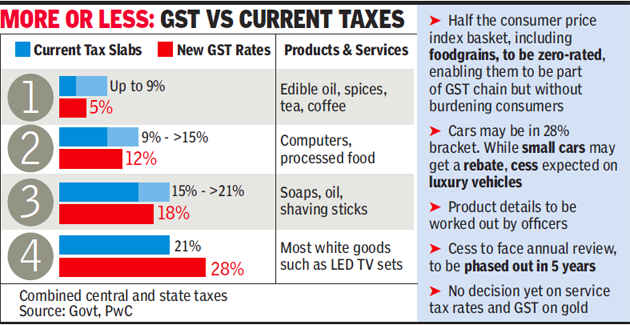

1) The GST Council trimmed the list of things in the top 28% GST portion to just 50 from present 228. So, only luxury and depravities products are now in the maximum tax strut and things of regular use are moved to 18%. Mr. Jaitley said that the Council over the months has been trimming things in the 28% list.

2) Eating outside in markets and restaurants becomes cheaper: All cafes will be charged the GST at 5% without input tax credit (ITC) profits. Although five-star restaurants within starred-hotels with room rent payment above Rs. 7,500 will interest 18% and can still advantage ITC profits, the council said. Outside cookery will interest 18% GST on ITC profits.

3) The top tax rate of 28% will now be charged on products like pan masala, fizzy water, and drinks, cigars and cigarettes, tobacco products, cement, paints, perfumes, Air Conditioners, etc. "These amendments in taxes are predicted to decrease charges and increase ingestion and thus bring development for the customer goods and trade industry," EY India said in a declaration.

4) GST on 13 things has been condensed to 12% from 18%.

5) GST on two things has been carried into 12% GST portion from 28% brace. 6 things have been carried into 5% from 18% portion. GST on 8 things has been reduced to 5% from 18%.

6) The tax rate on 6 things has been dropped to 0 from 5%. Tax on pouring choppers and armored automobiles was reduced from 28% to 12%. The tax rate on 6 things was condensed from 18% to 5%, on 8 things from 12% to 5% and on 6 things from 5% to 0.

Comments

Post a Comment